How to make your property stand out online

Do Agents Still Need to be Local?

How much do estate agents charge to sell your home in Sydney?

There are many ways estate agents can charge to sell your home, however agent fees are being disrupted now more than ever before!

I guess it’s time to bring you up to date with what’s been happening!

Did you know that there are 3 main ways estate agents can charge you to sell your home? Most real estate agents don’t want you to know about the third option… but it’s your lucky day today, because I’m going to unpack it all for you!

“Thanks Joe! “

The Traditional Commission + Marketing approach

But before we get into that, let’s unpack the traditional way estate agents charge (as this is still the most common fee structure in real estate).

Traditionally, real estate agents in Sydney have charged a commission rate on the final sales price. The typical commission rate in Sydney will hover around 2.2% (including GST).

They charge marketing costs on top of their commission, which includes photos, video, online ads and other extras. So marketing costs will be on top of the commission amount.

Average commission rates change by Suburb!

According to the blog at Open Agent, the average commission in Glebe for example is 2.15%, whereas in Surry Hills it’s 1.97% and 1.95% in Woollahra.

So the exact rate will change by area, and if you’d like to see what the average is for your area, you can use this search function or the calculator with Which Agent.

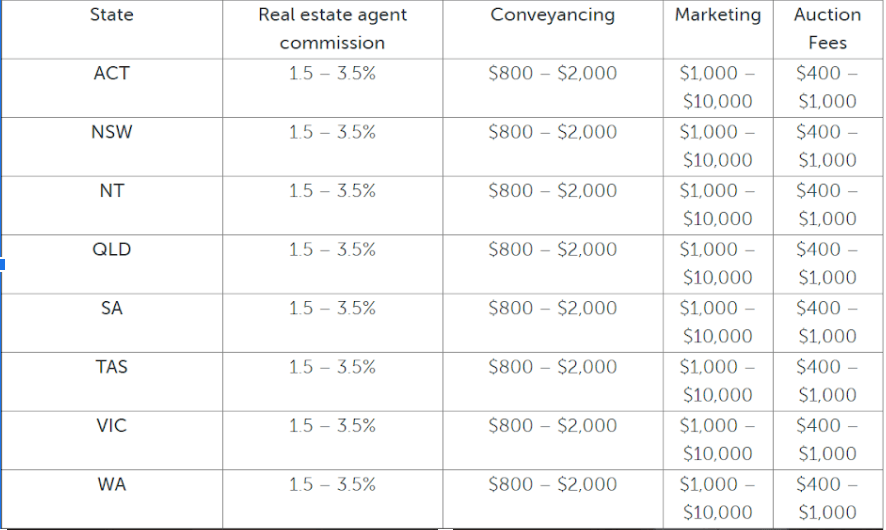

Comparing commissions to different states

This table from listing portal realestate.com.au suggests that across the country:

- Commission rates range from 1.5%-3.5%.

- Conveyancing ranges from $800-$2000

- Separate marketing charges typically range from $1,000-$10,000.

We should point out that there is a big difference between 1.5% and 3.5%! On a $1.5 million property, that’s $22,500 compared to $52,500! A difference of exactly $30,000…

Auctions

Auctions are perceived to be very expensive but this is a little bit of a myth in real estate – even in Sydney. My own father, who is a developer and has worked in property for almost 30 years thought auctions cost way more than private sales!

The table from REA above is actually pretty accurate as a guide: an auction only an costs up to $1,000 more than a private treaty campaign. This may be interesting for you as there are a lot of advantages to selling by auction if the market conditions are right.

It’s Not Regulated, and there are alternatives

We should point out that the way agents charge is not regulated, as you’ve seen from the range of commission rates. Now more than ever, there are different options to get a home sold.

Tiered Splits

Tiered splits are sometimes negotiated by sellers and agents. This is where the commission rate itself will actually change depending on the final sales price achieved.

For example, the base rate might be 2.2% if the agent achieves $1.5 million or lower. But this climbs to 3.5% for any amount above $1.5 million. The 3.5% applies to the difference between the higher and lower price.

For example, on a $1.7 million sale, the commission would be 2.2% of 1.5million + 3.5% of $200,000 (which is the difference between 1.7 million and 1.5 million).

This is $33,000 + $7,000, making a total tiered commission of $40,000.

This structure makes sense if you believe that a higher commission for the agent creates greater incentive and ability for them to achieve a higher price. Some in the industry find this controversial, suggesting that the agent shouldn’t need any more motivation to get a higher price.

I wonder what you think?

Low, fixed, flat fee model which includes marketing

On the complete other end of the spectrum is the fixed, flat fee model made famous by Purple Bricks.

A fee that is low, flat and fixed will be kept the same independent of the final sales price or area. It will include marketing rather than give you additional expenses to the selling fee. (Remember in Australia, the norm is to charge 2.2% commission and then add marketing costs on top of that).

So if the fee is fixed at $9,999 for example, then it doesn’t matter if the property sells for $600,000, $1.5 million or $15 million. All that will be charged to the seller is $9,999.

Purple Bricks…

Whilst Purple Bricks has been bashed in the media for ‘failing’ in Australia, the business made a large impact in the UK and USA.

Not only that, but following their entry into a poor property market in Australia in circa 2017, they are still estimated to have sold 7,700 properties in around 2 years. Not bad for a ‘failure’. This shows there is big demand for no-commission and low fee alternatives amongst Aussie sellers.

The Thinking behind low fee

The low, fixed fee structure supports the idea that commission doesn’t actually motivate an agent to get a better price. As Sydney Listings currently uses a low, flat, fixed fee, this is obviously what our agency believes at the moment.

Obviously this debate will continue for some time but for now I want to make the following points:

Obviously this debate will continue for some time but for now I want to make the following points:

- Not all fixed-fee agencies are created equal. For example, there are very few similarities between Purple Bricks and Sydney Listings as you can see here if you need.

- We can measure these results. For example, on this sale in North Kellyville Andy Diaz achieved a ridiculous $1.41 million for a sale on a low fee model in 2019.

- I believe that commission will motivate some agents more than others. Some agents are motivated to get the price for the client and won’t be as concerned by commission as others.

Where did the commission model come from?

I think it’s always healthy to mount a challenge to the way we do things. How else do we make industries like real estate better and fairer over time? My process for testing whether something is still needed is to look back as to why it was created in the first place.

This agent select article suggests that the hot market in Sydney and its desperate buyers creates a certain demand. This demand puts agents in a position where they don’t feel downward pressure on their commission.

The reality is that the commission model was started at a time where real estate processes were more manual, and when property prices were lower. Thus, the fees had to be higher to make working as an agent feasible.

Since then, real estate agencies have been riding property price growth. Learn more about why agents charge so much commission here.

From our perspective, the commission charging business model is out of date and needs a refresh. It should not cost tens of thousands of dollars to sell a home anymore.

What can you buy in Sydney for $600k?

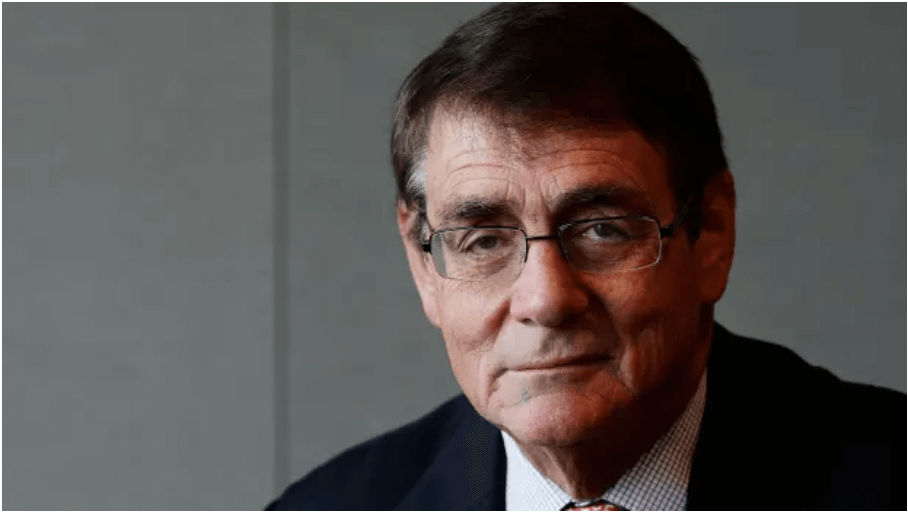

Economic and Property Outlook August 2019 with Bill Evans

Bill Evans is Westpac’s Chief Economist, and has been so since 1991. As identified in our video, he is known for being clear and fearless in his predictions.

I was fortunate enough to hear Bill speak at this morning’s Westpac Property Breakfast. This article is intended to pass on the insights gained in order to help our community make better decisions in the short to medium future.

Rate Cuts

Evans pointed out that the RBA Governor is willing to cut rates down to 0% eventually. This will depend on the reaction from other central banks around the world, such as the Fed. We are already seeing negative interest rates in Europe!

In Australia, further rate cuts are expected in October 2019 and February 2020 by Evans.

In the USA, Evans believes we will see cuts in September, October and November!

Recession

“I don’t see a recession happening in the USA” was the opinion. Obviously this has been discussed a lot lately with so much happening across the world and in the US. “Those people who say there is a 40% chance of recession… if a recession happens they say they predicted it. If it doesn’t, they say ‘well that wasn’t even my major position”.

Thank you Bill Evans, for your directness.

“Those people are useless”.

Many look at the US’s inverse yield curves as a sign of trouble, but Mr. Evans interpreted this as the attractiveness of US bonds to international investors. As he puts it, these look a lot more promising than other alternatives internationally.

Currency and the Dollar

The Australian Dollar is predicted to continue to lower in relation to the US Dollar, down to around 0.66 in 2020. This is making attractive commercial property investment in Sydney and Melbourne. As valuations are favorable on these markets, a weaker Aussie Dollar will create incentives for foreigners here.

The Euro is also expected to fall in relation to the US Dollar. Sounds like a good time to stock up on some USD!

Australian Economy

Two big areas of concentration are poor wages growth and unemployment numbers.

Wages growth is required for consumer spending to rise. Consumer spending increases business confidence. This in turn drives the economy.

The savings from interest and tax rate cuts will bolster household incomes, but this is likely to be allocated towards debt. Consumer spending will not be bolstered Evans believes – in fact consumer spending will continue to be weak.

Housing

The sharp increase in auction clearance rates post election in Sydney and Melbourne is very predictive according to Mr. Evans. It indicates the recovery is likely stable and here to stay.

Sydney and Melbourne prices have steadied since May, and increased by 1%. Some outlets are predicting 10% increases in prices in Sydney over the next 12 months. Evans strongly disagreed with this idea, and few could doubt this stance. Increases of this size would not be sustained as affordability thresholds would hamper these gains.

The consistent story for price changes is a period of steady growth, which seems highly likely. The downturn does appear to be behind us.

Population Growth

Population growth remains strong in NSW and will remain a positive driver. The economy is driven by productivity and population growth. For NSW, this migration comes internationally of course.

Interestingly, Evans predicted when the impact of migration on prices would really be seen. Forecasts at the moment are that construction completions will level off in the middle of 2020. After this we can expect to see stronger demand as a result of strong population growth.

Interestingly, Evans predicted when the impact of migration on prices would really be seen. Forecasts at the moment are that construction completions will level off in the middle of 2020. After this we can expect to see stronger demand as a result of strong population growth.

Rental Market

Sydney’s rental market is in it’s worst state since the early 2000’s. Vacancy rates are at 3.3%, and we are noticing this directly in our office. Despite this our property management team have had some properties leased off first inspections. But this is only when prices are correct at the start of a campaign.

Otherwise we’re seeing old apartments in particular suffer from longer vacancies and days on market. Based on the insights from the Breakfast, we see this picture changing once construction completions level off in the middle of 2020.

Summary – what does this mean for me?

If you are looking to buy in Sydney, the next 12 months seems like a great time to do so. Particularly if the rental market is rectified to help with those holding costs.

This doesn’t shift my opinion in terms of what to buy though – check out our resources at Sydney Listings for guidance on good area features and property features.

If taking advantage of low interest rates, make sure you allow a buffer but we don’t expect a sharp rise any time soon. It never makes sense to be fully leveraged, especially when there is uncertainty in other areas of the world economy.

By Joe Wehbe