If only finding a tenant were as simple as uploading some smartphone photos of our property on the internet.

Some property managers make it sound this easy… I call these property managers debt-collectors. They sit back and do little other than charge a % just for collecting your rent!

They expect tenants to come to the property, whereas a real property manager hunts for a tenant for your property.

I believe all landlords are entitled to the hands-off, feet-up landlord experience

I believe all landlords are entitled to the hands-off, feet-up landlord experience, given they’ve done the hard work of saving for and securing a property. So, if you haven’t leased your property yet, this is the post for you.

I’ll run through our Sydney Listings diagnostic tools for when a property hasn’t leased straight away, and what you can do about each type of problem.

Reason 1 – No views or enquiries online

If no one is seeing the ad for your property online, then no one will enquire or show up to inspect your property. This means no one will lease it any time soon.

First, always check how many views your property ads are getting on the internet.

How to check the number of views on your property ads

This is simply done through the back-end of realestate.com.au, domain.com.au, or any other listing portals you are using to rent out your property.

There’s a few examples below.

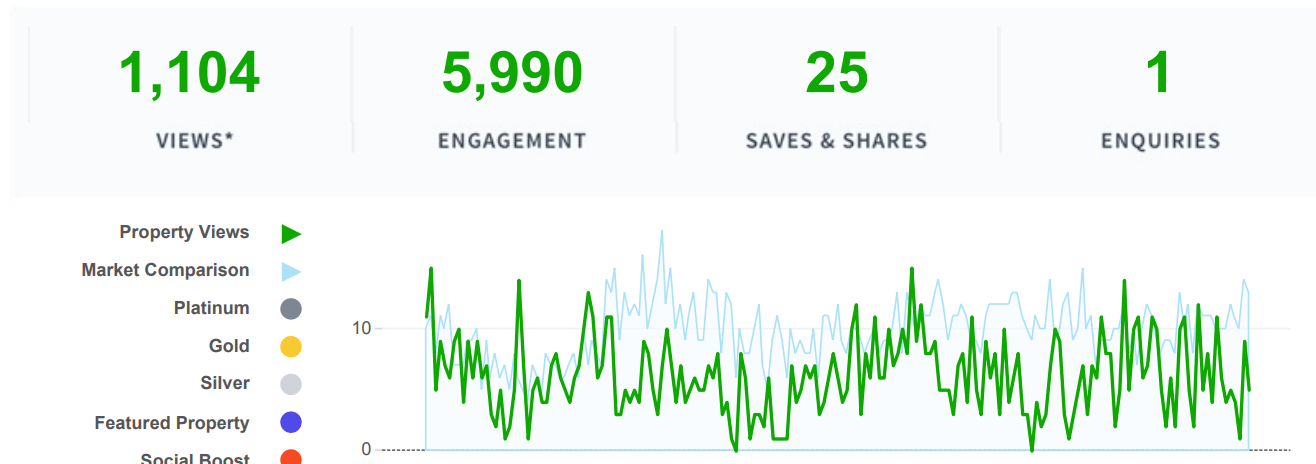

Domain.com.au Example

In this example the green line shows the property views, and the light blue shows the views of similar properties on the market at the same time.

What you can see is that there are not a high number of daily views (usually less than 10 per day) but that this is consistent with the market.

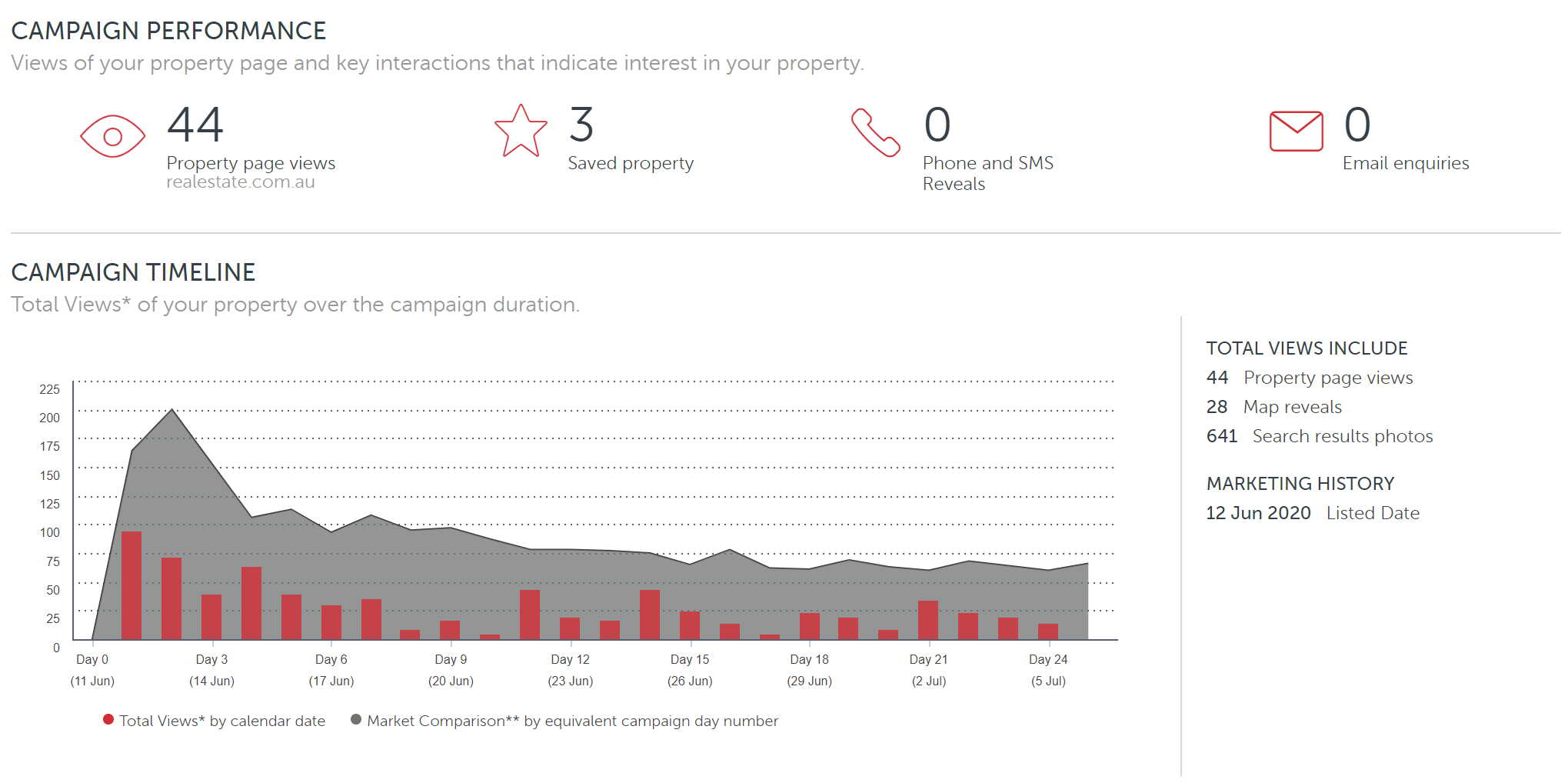

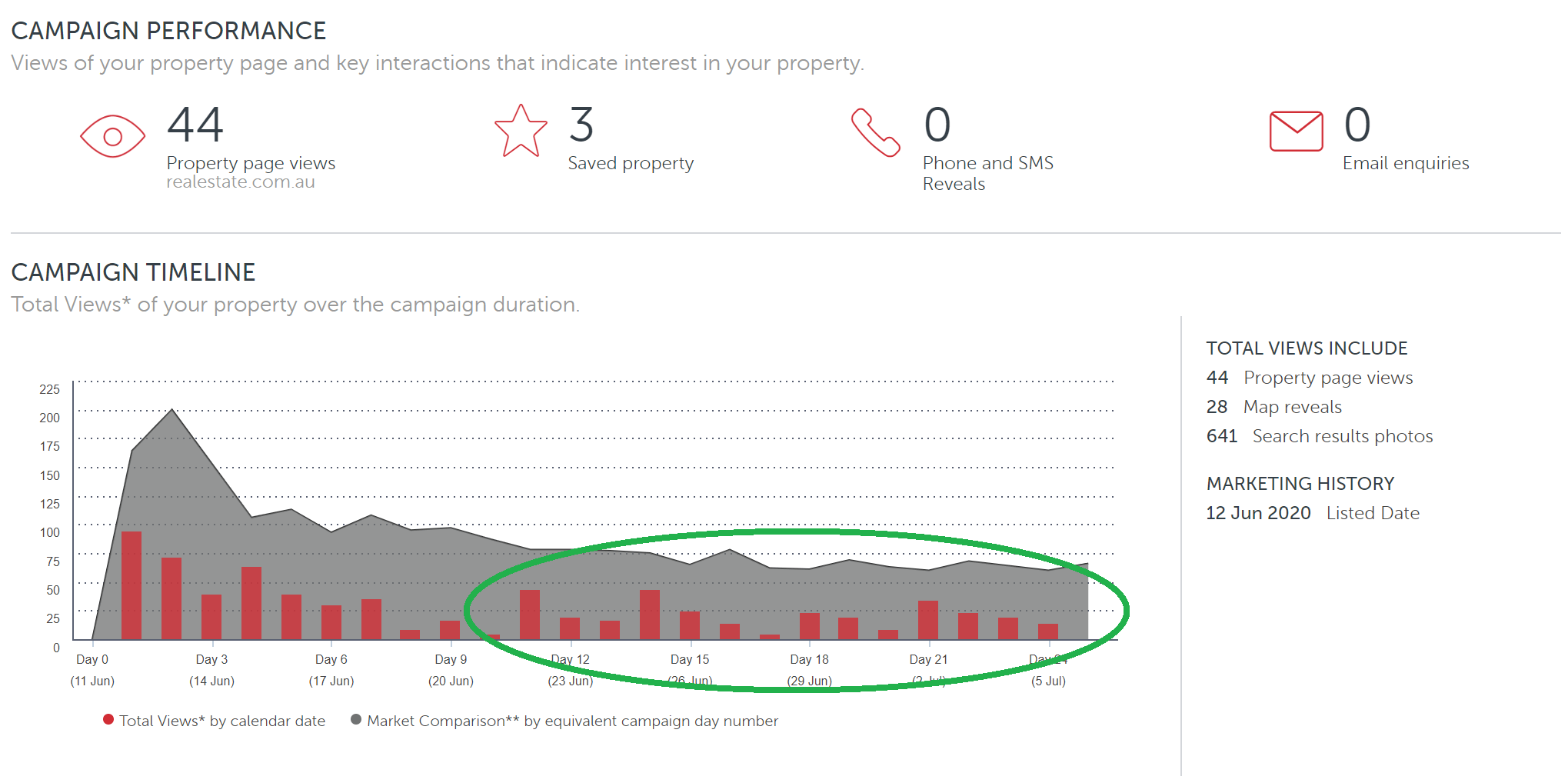

Realestate.com.au example

In the realestate.com.au example during the COVID-19 downturn, even though the total views (red) are lower than the market comparison (grey), they start off quite high. 75-100 views in a day is definitely a lot, and should be generating enquiry.

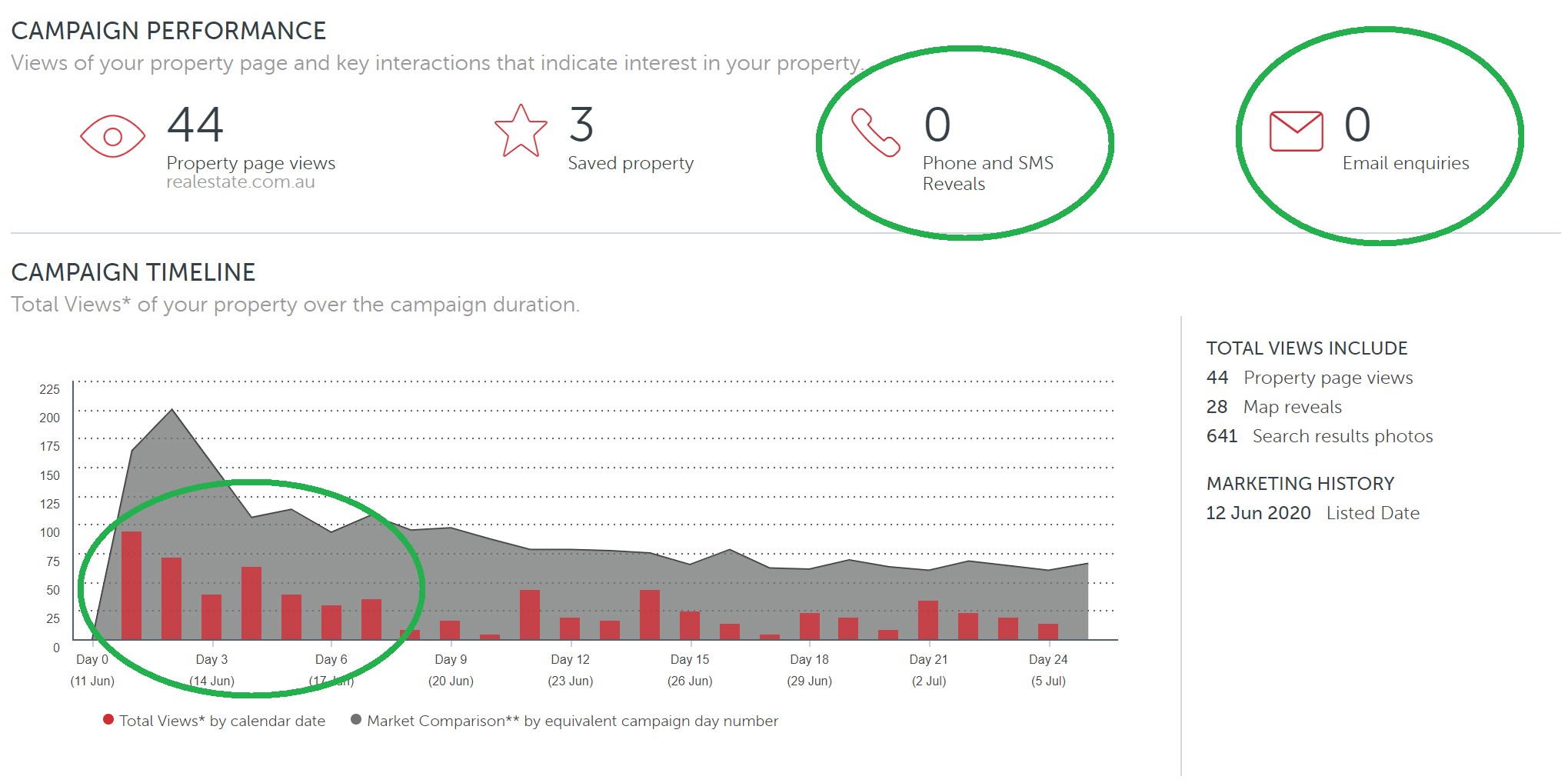

What to do about low views

In this green highlighted section of the analytics, the views are a bit lower. What could we do to increase the eyeballs that are seeing the property?

- Price a property accurately from Day 0 … this doesn’t sound helpful, I know! But a good lesson when you are struggling to lease is to take advantage of the first week of advertising next time you’re on the market. Properties get more attention when they are uploaded to the internet. (Check out our book on the 6-steps to doing this)

- Pay for upgraded advertising– on both realestate.com.au and domain.com.au, you can pay to have your property ad show up higher in the list of search results. The upgrade cost varies based on suburb, but will always be less than a week of rent, so it can be worthwhile.

- Revise Pricing Strategy – tenant searches filter out for their desired price. This means that by lowering price, you might appear in more searches – whilst normally a last resort, it is better to do this sooner rather than later.

Hint: Take special care of ’rounded numbers’. For example, tenants are more likely to screen a search for “$500-$550 per week” than say “$495-$555 per week”… so make sure your property isn’t narrowly missing out on search parameters!

Reason 2- Views but no enquiries

In the above example, we are getting a lot of property ad views, but not as much enquiries or property page views (people clicking into the ad).

As pointed out my book (The PROVEN Strategy to Leasing Your Property In ONE WEEK), our first job is to sell the click, not the rental application.

To get people interested in the property as they scroll online, we need a well-presented hero photo showing off an amazing part of the property, as well as a competitive price.

The photography and the display price work hand-in-hand to sell the click. So how do we remedy this?

How to increase enquiry and inspection levels

- Quality online advertising – photography is the most important part of this. For a rental property, you shouldn’t need to spend more than $120-150 on quality property photos that can be re-used for years.

- Box Brownie – Paying around $40 to virtually stage one photo with furniture, will make your property stand out when potential tenants are scrolling online. Click here for Box Brownie.

- Pricing Your Property – this is explained here. If you need further help, contact us to help price your property more accurately.

Reason 3 – Busy open homes but no applications

If people are enquiring as well as showing up to inspect your property regularly, then there must be a good reason why it hasn’t leased yet.

There are two possibilities: Price or Presentation.

In my book on the PROVEN Strategy I emphasise the importance of presenting your property like a luxury listing.

This is important given that you are competing with other properties in the marketplace. If they are presented in a better and cleaner way, but are at the same price or slightly higher, you’re likely to lose out on the tenant.

Top tips for touching up presentation

- Touching up paint

- Improving natural or internal lighting

- Decluttering the property

For more on property presentation, check out this video.

If price is the problem, that will become clear in the feedback from open home attendees via your property manager. You’ll notice lots of applications coming in low, attempts to negotiate, and complaints that your property is more expensive than others in the market.

Good luck and remember – stay hands-off, feet-up!

Keep the image in mind of the hands-off, feet-up landlord that you deserve to be. Turn that rental campaign around, and get your property investing path back-on-track.

Another example is kitchen size. A small kitchen might be adequate for a renter who lives alone and is on the go, but would potentially alienate a family from living in the dwelling.

Another example is kitchen size. A small kitchen might be adequate for a renter who lives alone and is on the go, but would potentially alienate a family from living in the dwelling.

We take effort to screen tenants before securing them in our landlord’s properties. This is by conducting reference checks and gathering a wealth of supporting documents on an application. We also place an emphasis on pre, post and mid tenancy education of our tenants. Check out some of our

We take effort to screen tenants before securing them in our landlord’s properties. This is by conducting reference checks and gathering a wealth of supporting documents on an application. We also place an emphasis on pre, post and mid tenancy education of our tenants. Check out some of our